Interview with Manager of Treasury & Control Conny Ng

With a real estate portfolio consisting of over 1,500 homes, spread across various cities in the Netherlands and Europe, it is important for real estate investor Van der Vorm Vastgoed to make clear choices in the area of finance. All the more reason to talk to Conny NG, manager Treasury & Control, about her role and the approach of Van der Vorm Vastgoed Groep.

How long have you been employed at Van der Vorm Vastgoed Groep and in what position?

Since November 2018, I joined Van der Vorm Vastgoed as Manager of Treasury & Control. Prior to that, I held various financial positions at ING Real Estate, later acquired by CBRE Global Investors, for 10 years.

What does a manager of Treasury & Control actually do?

In a nutshell, I am responsible for the cash flows and financings at Van der Vorm. Millions go into our organization with purchases, sales, costs and revenues. These cash flows must be properly aligned so that we remain a healthy organization.

What is the most enjoyable part of the Manager of Treasury & Control position for you?

The most enjoyable part is keeping a good overview of our financial resources to grow in a natural and healthy way. A challenge is to be well informed about all projects. As a result, I have to deal with many different colleagues and consultations take place regularly.

As manager of Treasury & Control, what is a success from the past period that you are glad you were a part of?

When I joined Van der Vorm, this was a new position. Together with my colleagues we were able to bring more structure to the Treasury organization and as a result we are able to better inform the management so they can make decisions based on the right information. In the past we reported historical data and now we are looking forward. We are not quite there yet and can pick up more parts within the department. Think for example of more digitalization.

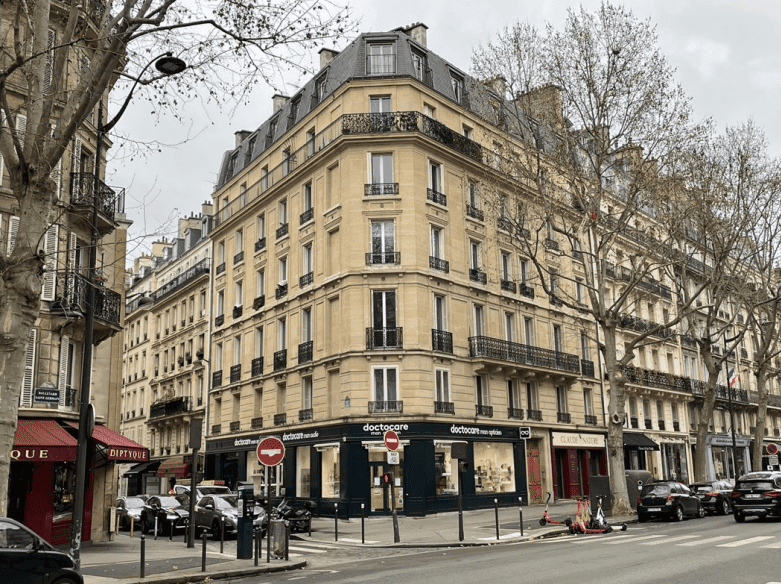

I am also extremely proud that we were able to onboard a new foreign financier for the French operations, where we were able to reach agreements for the next ten years. In which we were also able to gain a nice advantage and we as a Finance department can also contribute to the company's results.

Do you influence which investments fit the strategy/portfolio objectives of Van der Vorm Vastgoed Groep?

I do not have direct influence on investments, but I do have indirect influence. From a financing and cash flow perspective, I can indicate the limits of the possibilities. Also by informing the management about the possibilities in the financing market for certain segments of investments that may or may not be attractive to financiers, I can influence the policy if it is of decisive importance for the return to be achieved.

Within Van der Vorm Vastgoed Groep , together with the CFO, you will be responsible for day-to-day cash management and inter-company financings and provide reporting and forecasting. How has the past "corona year" affected your work and the performance of your function within the Group?

Corona made it a bit of a switch because there was less physical contact with colleagues. Contact through MS Teams worked well, but the corridor conversations turned out to be very valuable.

Through the necessary digital communication, we have discovered a new way of sharing information and I myself have become more visible as part of the whole.

How do you weigh social and financial returns? What are any difficulties in finding the balance between the two?

With social returns, we look more at the product than the financing. Products with a social return are generally more interesting for banks to finance.

You work together with multiple colleagues from different departments and across different countries. What issues are you currently encountering?

The current play is that we are growing tremendously in Poland - in 2016 VdV started with Polish investments with a number of test apartments. This has now grown to more than 300 and we plan to add over 200 more apartments. We are working with several partners/managers there and want to move towards centralizing this more in order to achieve economies of scale. In addition, the professional investor market is a new product for the Polish financing market, so financing, for example, is still difficult.

Sustainability plays an increasing role in the (re)development of real estate. What effects does this have on well thought-out budgeting?

Budgeting and expected direct returns specifically make room for this. Financiers are also placing more demands on the sustainability of real estate; for example, they do not finance office buildings with energy label C. Sustainable investments are more something for the long term and the belief in the long-term increase in value or preservation of the property.

What does a tenant notice about Van der Vorm Vastgoed Groep in their real estate experience based on decision-making made based on your financial reporting?

Tricky question, but good to dwell on. I don't think a tenant notices anything directly based on my financial reporting, except perhaps an occasional visit from an appraiser.

What trend(s) do you observe that create and maintain long-term value for tenants and investors?

That we are investing more and more sustainably so that the end product can also contribute to the environment. We also take much more account of the wishes of our tenants in new developments. Take for example the Tiny Houses which we have built at our Harvest The Hague property. A beautiful and sustainable product.

What insight have you gained in the past year, in the crisis period we are in now?

That the team can work well together even remotely and that we really do our best for Van der Vorm. It also showed that Van der Vorm has a resistant portfolio and financiers, even during and after Corona's time, still welcomed us with open arms.

What do you expect from the finance management of the future?

I expect our Finance team to digitize more and our reports can be compiled in a shorter time frame so we can add more quality to the analysis in the time saved.

Do you have any further additions, or things you would like to have named?

I am happy to be working at Van der Vorm Group and to contribute to further professionalize the organization to create an even more beautiful organization for the future.

What do you like about the organization?

It is a real family business so most people are very involved and you have a good drive to go for it together. Because of the young people there is also a good informal working atmosphere. Van der Vorm also tries to push your own boundaries in a healthy way by trying to bring out the best in yourself. For this they offer courses and training. One example is that I really like accounting myself and in the meantime I have also become responsible for the financial part of the Polish investments.

Want to know more about Conny, our projects or our organization? Check out: www.vormvastgoed.nl and follow us on social media.

#aboutus #finance #treasury